To make sure you're prepped for it, try using a self-employment tax calculator so you know how much to save up.

If this is your first year as a Flex driver, that 15.3% can land you with a tax bill much heavier than you're used to seeing. They come to 15.3% for you, compared to the 7.65% paid by traditional employees. When people talk about "self-employment tax," they're referring to this doubled payment of Medicare and Social Security taxes. That makes you responsible for paying both shares of tax. But you're legally considered both the employee and the employer here. But their employers give them a hand here, matching all of their tax payments. There are two parts to self-employment tax: Medicare taxes and Social Security taxes. These fall into two major categories: self-employment taxes and income taxes. (Hint: It involves tax write-offs!) But for now, let's talk about the not-so-fun stuff: all the taxes you'll have to pay. As far as taxes go, you're on your own - which comes with some major headaches and some perks. For one thing, Amazon won't take care of withholding for you.

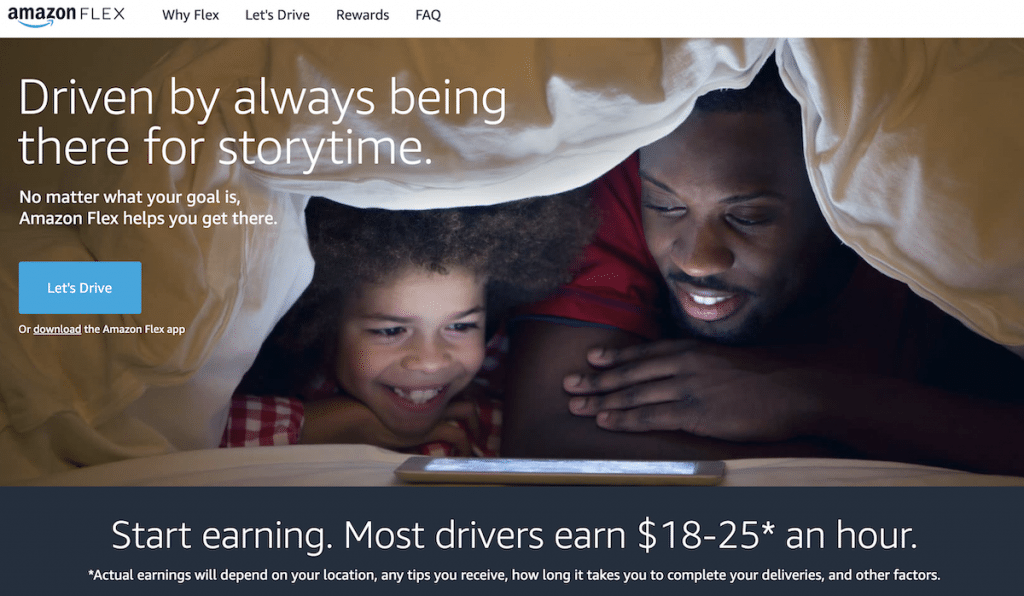

Independent contract work means a lot of freedom on the job, but things can get tricky when finances come into play. Like rideshare drivers, real estate agents, and even small business owners, you belong to a growing part of the US labor force: people who want to set their own hours and be their own boss. If you drive for Amazon Flex, you're classified as an independent contractor - not an Amazon employee. The taxes you have to pay as an Amazon Flex driver

0 kommentar(er)

0 kommentar(er)